How to choose the best bank

The importance of Independent Banking Service

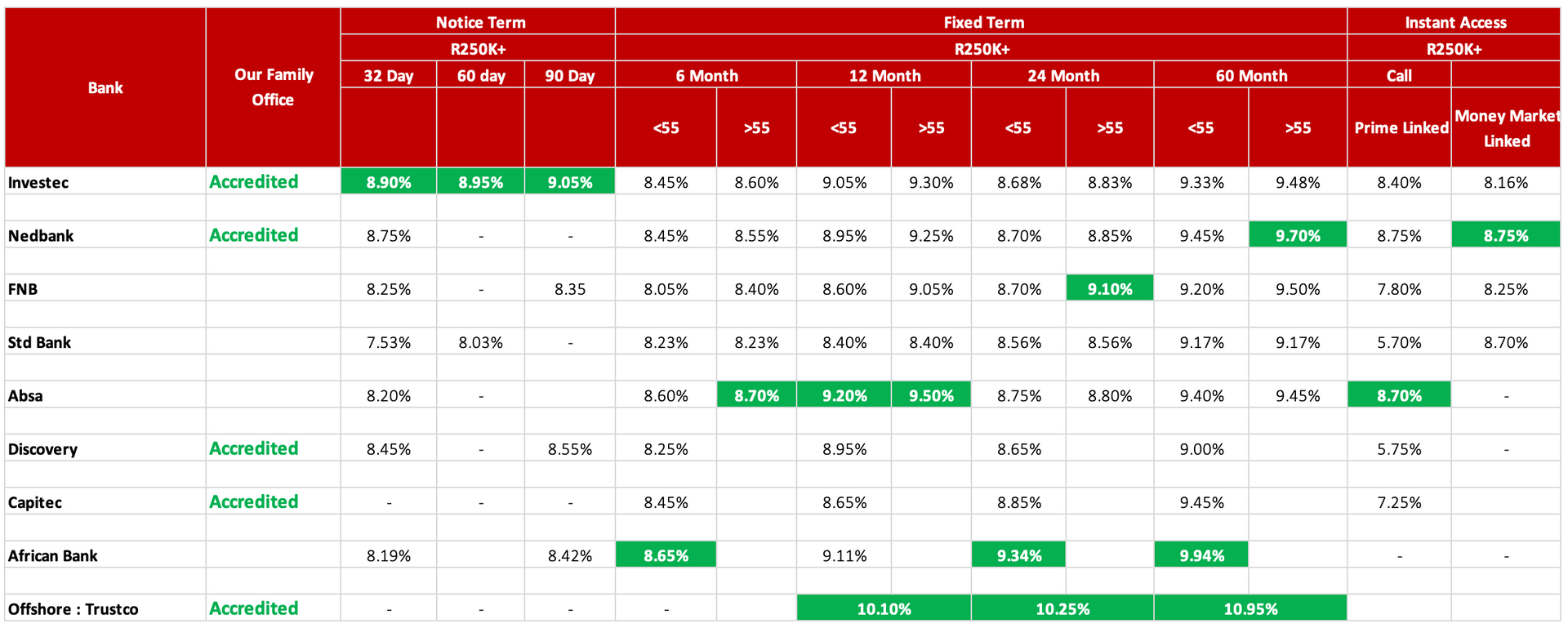

South African banks compete on rates with each other every month. No bank will offer the best rate for each category client. Some banks focus on clients over the age of 55, others focus on notice accounts, fixed deposits or access accounts. The case can be different every month. This is why you need an independent banking partner to ensure you obtain the best suitable banking rate in the market at no additional cost.

Gross Rates updated June 2024

Banks compete with each other on savings rates primarily to attract depositors and grow their customer base. Here’s how they typically approach this competition:

- Offering Higher Interest Rates: Banks will often advertise higher annual percentage yields (APYs) on savings accounts to attract customers. A higher APY means more interest earned on deposited funds, making the account more attractive to potential savers.

- Promotional Rates: Banks may offer temporary promotional rates that are higher than their standard rates to incentivise new customers to open accounts. These rates typically last for a limited time to encourage prompt action from potential depositors.

- Tiered Interest Rates: Some banks offer tiered interest rates where higher balances earn higher rates of interest. This encourages customers to deposit more money into their accounts to earn better returns.

- Online vs. Brick-and-Mortar Rates: Online banks often have lower overhead costs compared to traditional brick-and-mortar banks. Consequently, they can sometimes offer higher savings rates to attract customers who are comfortable managing their finances online.

- Rate Matching: When a competitor offers a significantly better rate, some banks may match or even exceed that rate temporarily to retain existing customers or attract new ones. This can lead to a temporary spike in rates across several banks in a competitive market.

- Market Conditions: Banks also adjust their savings rates based on broader economic factors such as changes in the Reserve bank interest rates or shifts in market demand for deposits. This ensures they remain competitive while maintaining profitability.

Overall, competition among banks on savings rates benefits consumers by providing opportunities to earn higher returns on their savings. It’s essential for customers to compare rates, terms, and conditions before choosing a savings account to ensure they find the best option for their financial goals.

Contact us today to obtain the best suitable rate for you.

Submit your request

Sign up to our newsletter

We will get back to you as soon as possible

Please try again later

Blog

Authorised Financial Service Provider FSP 50677